In a stunning turn of events, Ndindi Nyoro — once the loudest voice defending President William Ruto’s economic blueprint — has finally said what many Kenyans feared: the country is teetering on the edge of default.

Yes, you read that right. Kenya’s debt crisis isn’t just looming — it’s knocking at the door.

With the national debt now standing at a staggering Ksh 11 trillion, even government insiders are sounding the alarm.

Nyoro, the former Chair of Parliament’s Budget Committee and a close Ruto ally, has openly admitted that the situation is spiraling. Just servicing interest on the debt costs Kenya over Ksh 1 trillion annually, and the government has quietly begun debt restructuring talks with China — a move that screams desperation.

Let’s be clear: this isn’t just about numbers. It’s about lives.

Prices are skyrocketing. Taxes are suffocating businesses and households alike. Investors are pulling back. Jobs are vanishing. And all the while, the borrowing continues — not to build, not to grow, but just to survive.

Even Nyoro confesses that the aggressive tax hikes have backfired. Instead of boosting revenue, they’ve stifled spending and drained investment — further shrinking the government’s earnings.

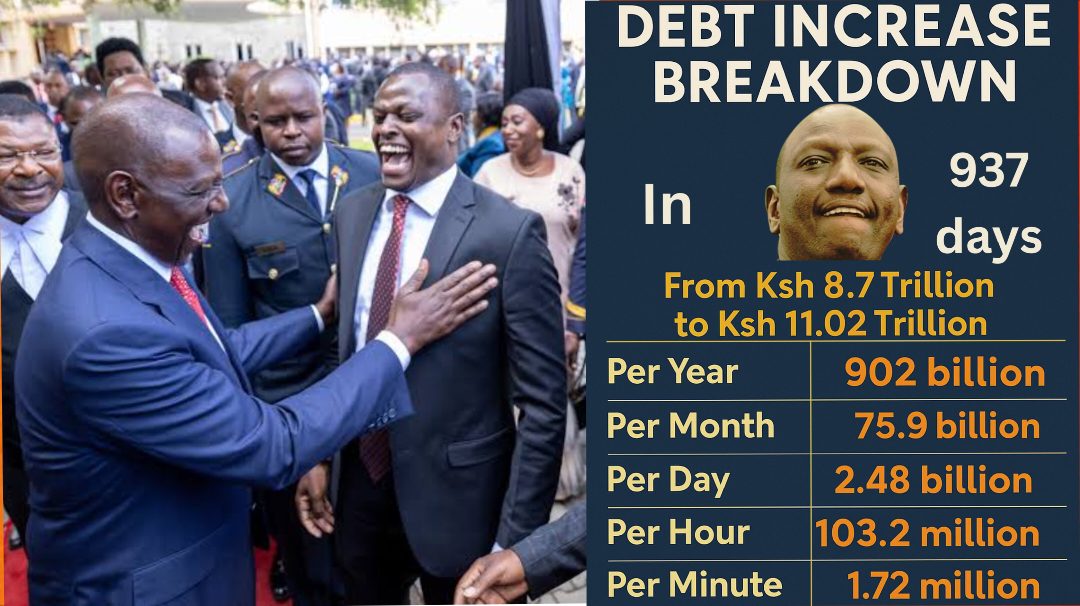

To put this debt madness into perspective, let’s look at the numbers.

Since president Ruto took office, Kenya’s debt has exploded from Ksh 8.7 trillion to Ksh 11.02 trillion — in just 937 days.

That means:

Ksh 902 billion per year

Ksh 75.9 billion per month

Ksh 2.48 billion per day

Ksh 103 million per hour

Ksh 1.72 million per minute

Ksh 28,650 every single second

Every second that ticks by, Kenya digs deeper into a financial black hole.

And while countries like Zambia and Ghana collapsed under their debt weight, experts now warn that Kenya could be worse off. Our interest payments are higher, our debt load heavier, and our citizens more strained.

So the question now is not if the storm is coming — it’s how much longer we can stay afloat.

Share your voice. Should Kenya pause borrowing? Comment below.